FieldPulse Financing: Flexible Consumer Financing for Service Businesses

Close more deals with FieldPulse Financing. Offer simple, transparent consumer financing options directly through your field service platform.

Oct 29, 2025

Homeowners are increasingly looking for flexibility when it comes to paying for home improvement projects, equipment upgrades, and emergency repairs. Offering consumer financing has become one of the most effective ways for contractors and service professionals to help customers say “yes” faster — without sacrificing cash flow or profitability

With FieldPulse , service professionals can provide customers with convenient, flexible payment plans that make it easier to move forward with projects of all sizes. This built-in feature removes financial barriers, improves cash flow, and gives service contractors a professional edge — all from the same platform where they already create estimates, send invoices, and manage jobs.

For today’s service pros, financing puts professional, trustworthy financing tools directly in your hands. Powered by trusted lending technology and financial partners, FieldPulse offers fast, transparent financing options without requiring you to handle sensitive financial data or leave the FieldPulse app.

In this guide, we’ll break down how consumer financing works inside FieldPulse, the common types of consumer financing, and the benefits for businesses that offer customers easy, transparent ways to pay. You’ll also learn how FieldPulse helps streamline the process from application to funding — all within the same platform where you already manage jobs, estimates, and invoices.

What Is Consumer Financing?

Consumer financing allows homeowners to pay for a project through a third-party lender rather than covering the full amount upfront. Once the loan is approved, the lending partner pays the contractor directly, and the customer makes manageable monthly payments over time.

By spreading out costs into monthly payments, consumer financing helps customers manage their money more effectively, reducing the immediate financial burden and making home projects more accessible.

It’s the same concept used for car purchases or retail goods — but now tailored for HVAC installations, plumbing repairs, and other service jobs. Homeowners gain affordable financing solutions, while contractors maintain healthy cash flow and reduce risk.

Through FieldPulse Financing , contractors can present these same flexible payment options directly within the app they already use every day. Customers can apply, get approval, and start monthly payments — all from the estimate or invoice you send through FieldPulse.

Monthly payments are automatically applied toward both principal and interest, making it easier for customers to stay on schedule while you get paid in full. This program strives to simplify both sides of the transaction — giving buyers access to fair financing and service businesses a frictionless way to close more deals.

Common Types of Consumer Financing

When a homeowner requests a quote for a new HVAC system, water heater, or electrical upgrade, financing options can make the difference between a lost lead and a booked job. Here are the most common types of consumer and service loans available through FieldPulse Financing and its lending network:

Installment Loans

A fixed-term loan with a consistent interest rate and set monthly amount. Once approved, the homeowner repays in predictable payments over time, often ranging from 12 to 120 months.

- Example: A $9,000 HVAC installation financed over 60 months results in affordable monthly payments, helping the customer decide without delay.

Promotional Financing

Sometimes called “same-as-cash” or deferred-interest plans, these give buyers time to pay without fees or interest if paid within a specific period. They’re ideal for limited-time promotions or energy-efficient upgrades.

Secured Home Improvement Loans

These loans may be approved FHA Title I or bank-backed products that use the property as collateral. They often carry lower interest rates and longer repayment terms, making them suitable for major remodels or full system replacements.

Unsecured Personal Loans

Fast-approval options where no property is required. FieldPulse’s lending partners evaluate credit and income instead. These are perfect for small- to mid-size projects like flooring, windows, or plumbing replacements.

Offering multiple payment plans through FieldPulse ensures customers can qualify for the right fit — helping your business close more sales while keeping buyers confident about their decision.

Benefits of Offering Financing Options to Customers

Contractors who provide financing through FieldPulse gain a serious competitive advantage. With FieldPulse's integrated financing options, both contractors and customers can save time and avoid common administrative hassles, making the entire process smoother and more efficient. FieldPulse Financing was designed specifically for field service professionals — giving customers peace of mind and helping contractors increase sales. By integrating payment flexibility directly into your workflow, you can remove price hesitation, close deals faster, and ensure your business gets paid immediately after job completion. Here’s why integrating service finance options into your business model pays off:

Increases Job Conversion Rates

When customers can spread monthly payments, they’re more likely to move forward quickly . With FieldPulse’s embedded financing tools, the option to apply and get approval in minutes helps eliminate price hesitation and builds trust early in the process.

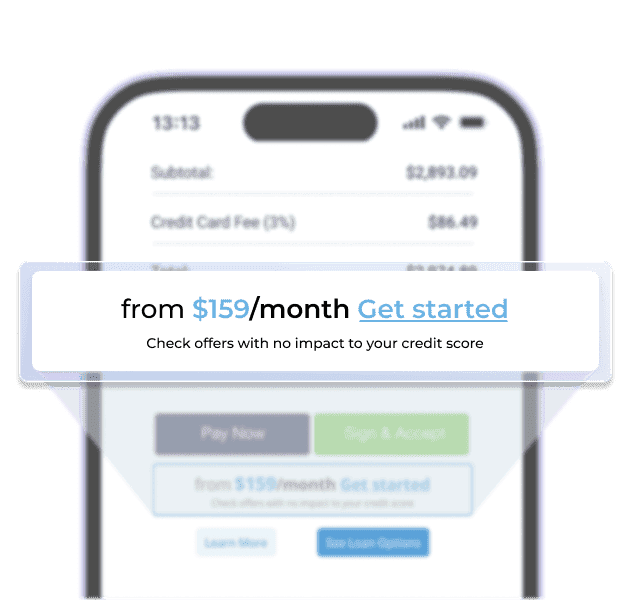

FieldPulse Financing displays affordable payment plans right on your estimates, helping customers see exactly how manageable a project can be — such as “$159/month” or “$89/month,” based on their selected terms.

Encourages Larger Purchases

Instead of cutting corners or delaying service, buyers can comfortably afford premium upgrades or full replacements. Financing turns major projects into realistic monthly amounts that fit within their budget — and FieldPulse makes it simple to present those plans during every quote.

Improves Cash Flow for Contractors

With FieldPulse, funds are typically disbursed within days of job completion — meaning you don’t wait on customers to pay or chase outstanding accounts. You get paid in full, while the lending network handles repayment.

Since FieldPulse manages the entire financing process from application to disbursement, your business receives immediate payment, even when customers choose to pay over time.

Strengthens Customer Relationships

Transparent interest terms, clear plans, and a simple approval process improve satisfaction. Customers feel supported and are more likely to return or refer your company — especially when the entire experience is handled professionally through FieldPulse.

FieldPulse's integrated communication tools ensure a fast response to customer inquiries, further enhancing trust and satisfaction.

Expands Your Market

Many homeowners have solid credit but limited liquidity. Offering financing through FieldPulse helps you reach more buyers, giving your service company a polished, customer-focused image that drives loyalty and repeat business.

Creating a Financing Strategy Within FieldPulse

A successful financing program isn’t one-size-fits-all. With FieldPulse, you can create a tailored strategy for your business by enabling FieldPulse Financing within your account.

When building your strategy, evaluate key factors like interest rates, loan terms, and repayment plans. By considering these elements, you can help customers select the right options, ensure manageable monthly payments, and reduce the risk of missed payments or late fees.

Working with FieldPulse’s integrated lending partners means you’re offering financing backed by trusted, vetted institutions — giving both you and your customers peace of mind.

How FieldPulse Simplifies the Financing Process

FieldPulse Financing is designed to make offering and managing consumer financing effortless — from application to approval to payment.

How it Works in FieldPulse:

- Create an estimate or invoice inside FieldPulse.

- Click to apply for financing — your customer receives a secure link to complete the application.

- The lending network reviews and issues instant approval decisions.

- The contractor is notified, and funds are released once the job is marked complete.

After completing these steps, make sure to download the latest pricebook or updates in FieldPulse so you and your technicians have access to the most current financing plans and tiers.

Everything happens within the same FieldPulse account you already use to create, manage, and collect job information. No separate systems, no manual documents, and no added administrative steps.

FieldPulse Financing Highlights:

- Loan amounts: $500–$100,000

- Terms: 3–240 months

- Trusted network of national lenders

- Fees: None for FieldPulse users

- Funding time: Some customers receive funds within 24 hours

By enabling FieldPulse Financing , contractors can offer customers instant access to capital for major upgrades or installations — helping you close larger deals, maintain steady cash flow, and simplify every payment interaction.

Monthly Payments: Making Projects Affordable for Customers

One of the biggest advantages of offering financing through FieldPulse is the ability to break down large project costs into manageable monthly payments. For many homeowners, the option to pay over time rather than all at once can be the deciding factor in moving forward with a home improvement, repair, or upgrade.

FieldPulse’s network of lending partners provides a range of financing solutions designed to fit every budget. Customers can choose from flexible payment plans with competitive interest rates, ensuring their monthly payment stays affordable and predictable throughout the life of the loan. Whether it’s a new HVAC system, plumbing upgrade, or property renovation, these financing options make it easier for buyers to access the funds they need, without putting their finances under strain.

Managing payments is simple and convenient. Through the payments section on the website, customers can access their account, review statements, and make payments online from any device. Automatic payment options and timely reminders help prevent missed payments, so customers can stay on track and protect their credit.

The program strives to provide financing for a wide range of customers, including those who may not qualify for traditional loans. With flexible credit approval criteria and a variety of loan options, more homeowners can qualify for the financing they need to complete important purchases and property improvements.

By offering monthly payment plans through FieldPulse Financing, contractors can help customers achieve their goals — whether it’s upgrading their home, making essential repairs, or investing in new services. Affordable, flexible financing solutions not only make projects possible but also build trust and long-term relationships between contractors and their customers.

Managing Customer Finances in FieldPulse

FieldPulse centralizes every part of the financing process so you can manage jobs, payments, and customer records all in one place.

You can:

- View active payment plans and fund status per job.

- Store signed documents, loan statements, and related customer details.

- Respond quickly when customers inquire about loan options, account issues, or need to file a complaint, using built-in communication tools.

- Reach support by phone for assistance with accounts or to resolve issues.

- Track which dealers or technicians are associated with each financed job.

By organizing everything inside FieldPulse, contractors stay ahead of the approval process, maintain compliance, and deliver a professional customer experience from start to finish.

Troubleshooting Common Financing Issues

Even the most streamlined financing programs can face occasional challenges like missed payments, credit declines, or delayed approvals. FieldPulse helps contractors stay proactive by providing visibility into every step of the financing lifecycle.

If a customer experiences payment trouble, FieldPulse’s lending partners offer customer support and repayment flexibility directly. This allows homeowners to adjust plans, avoid unnecessary fees, and maintain a positive payment history — while contractors stay focused on delivering great service.

By combining robust partner programs with FieldPulse’s management tools, you can reduce administrative friction, respond to issues quickly, and ensure smooth communication with every financed customer.

Delivering a Better Customer Experience

Offering financing creates a better customer journey. By embedding financing directly into your estimates, customers can review clear terms, choose a payment plan that fits their budget, and sign electronically, all within minutes.

This level of transparency builds trust and removes friction during the buying process. It also positions your business as a modern, customer-focused service provider that offers solutions for every budget.

Measuring the Success of Your Financing Options

To gauge how well your financing strategy is performing, track a few key metrics:

- Monthly payment completion rate: Indicates how sustainable your financing plans are for customers.

- Average interest rate: Helps you stay competitive and transparent.

- Total funds disbursed: Reflects how many customers are using your financing options.

Using FieldPulse’s built-in reporting tools, you can review financed jobs, compare outcomes, and identify opportunities to expand your financing offerings — all from the same dashboard.

Final Thoughts

For today’s trades and home service companies, offering consumer financing through FieldPulse isn’t just a sales tactic — it’s a customer expectation.

By embedding financing capabilities directly into the FieldPulse platform, service contractors can offer competitive, flexible financing options without juggling extra apps or payment systems.

When your customers can spread the cost of a project across monthly payments, everyone wins — your customers get flexibility, and your business gets paid faster.

With FieldPulse, you can create, manage, and review every financing option alongside your estimates, invoices, and job schedules in one place. FieldPulse and its financing partners ensure a secure, professional financing experience for both contractors and customers.

Ready to grow your business with flexible, professional financing options?

Explore FieldPulse and see how our integrated technology helps you close more deals, improve cash flow, and provide customers with the flexible payment plans they expect.

Get a Demo and see how easy it is to offer customer financing through FieldPulse — the all-in-one platform for running your service business.